GameStop Stock Causes Wall Street Frenzy

February 21, 2021

An unprecedented event developed on Wall Street in early January as GameStop stock began to soar despite its business problems. The stock rose dramatically due to the tactic called a “squeeze” employed by millions of collective small investors.

This tactic ignited a “David vs. Goliath” showdown that pitted a lot of small investors against big hedge funds and wealthy professional money managers.

Many of the small investors got the idea to come together by using a Reddit page called “Wall Street Bets.” Through this social media platform, originally founded by Jaime Rogozinski, the movement started out quite small but rapidly grew.

By the end of February, the page had 8.4 million members.

The small investors made the stock soar extremely high and started to gain attention from those on Wall Street. Citron Research, a high-level stock research firm, tweeted “GameStop buyers at these levels are the suckers.”

Despite criticism, the small investors continued to make the stock price soar. On Jan. 27 the stock reached its peak share price, topping out at $347.51 a share.

However, the small investors were dealt a major blow the next day when Robinhood, a financial service company that many of them used, decided to restrict transactions for GameStop stock.

This decision received lots of backlash from well-known lawmakers. Rep. Alexandria Ocasio Cortez said that restrictions on buying GameStop Stock were “unacceptable.” Other powerful and wealthy people, such as Elon Musk, agreed with her.

“It seems unfair that Robinhood restricted transactions,” junior Alan Na said.

Robinhood’s actions have been widely criticized as unjust.

The aftermath of Robinhood restricting transactions of the stock has led to the stock going back down to around where it was at before the small investors made the stock soar extremely high.

Robinhood restricting transactions of the stock has also led to many small investors losing money, as they were not able to sell their shares as the stock price dropped.

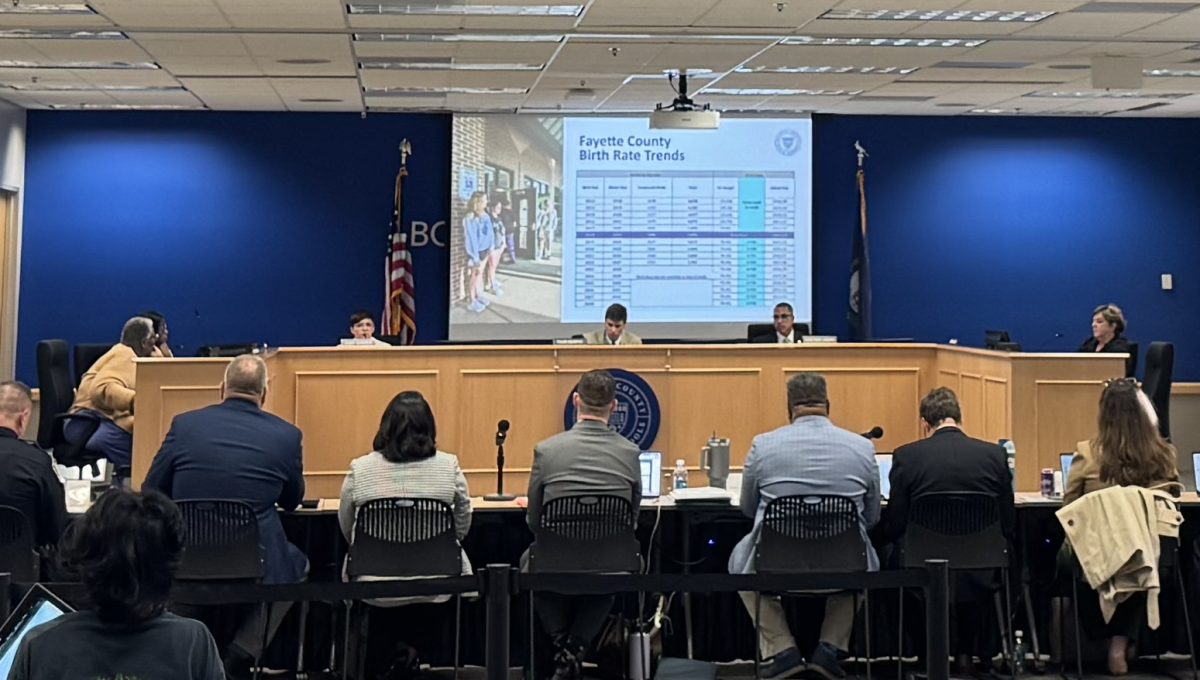

On Feb. 18, the House Financial Services Committee held a hearing primarily to get more information for why Robinhood took the actions that it did. While as of right now, the full impact of this short squeeze that millions of small investors carried out is not fully known.

However, it looks like Robinhood will certainly be in some legal trouble for a substantial amount of time due to their actions in the event.